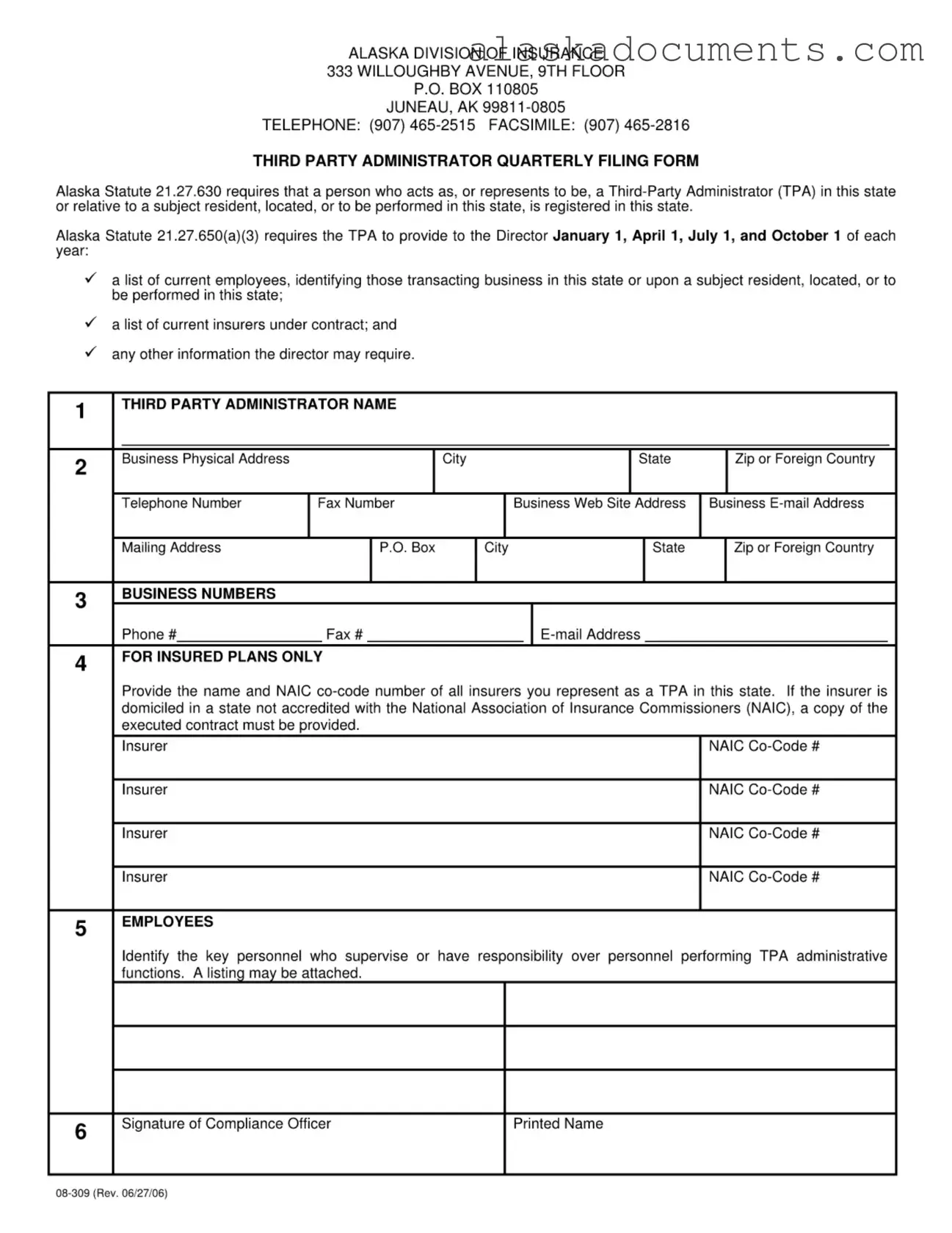

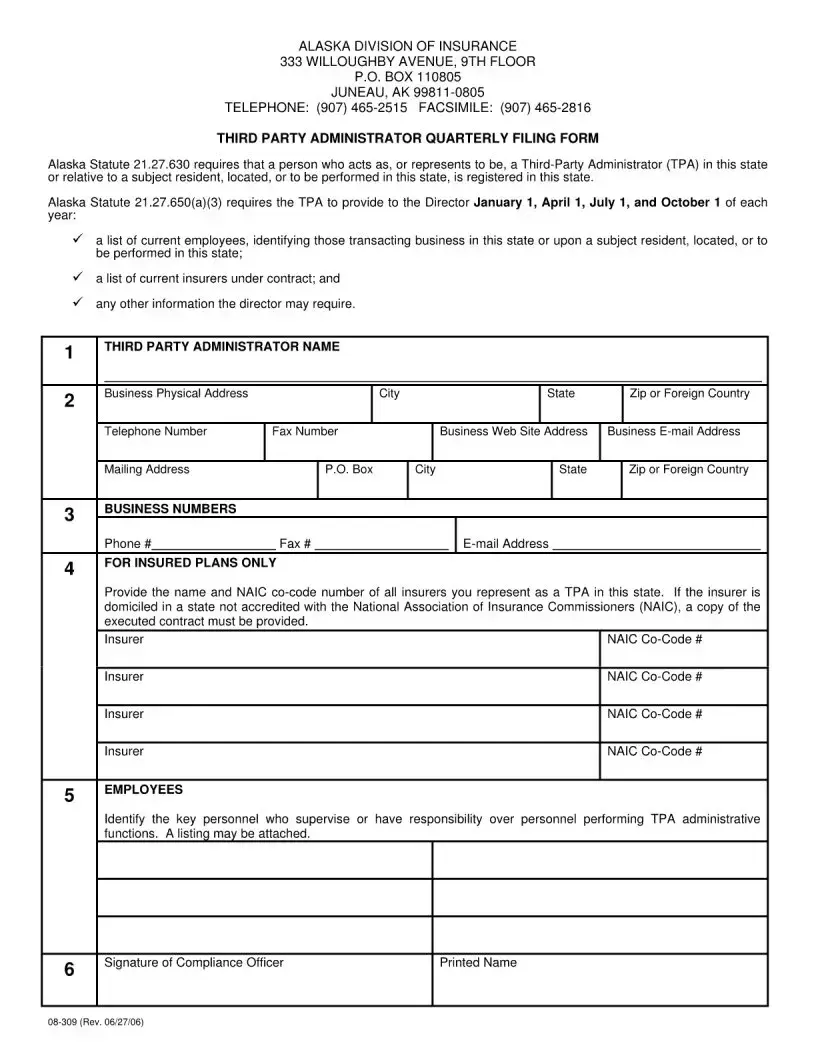

The Alaska 08 309 form is similar to the California Third-Party Administrator Registration Form. Both documents serve the purpose of registering third-party administrators (TPAs) operating within their respective states. Each form requires detailed information about the TPA’s business address, contact information, and a list of employees involved in transactions within the state. Additionally, both forms mandate the disclosure of the insurers with whom the TPA has contracts, ensuring compliance with state regulations and promoting transparency in the insurance industry.

Understanding the importance of third-party administrator registration forms is essential for maintaining compliance within each state. These documents, like the Alaska 08 309 form, the Florida Third-Party Administrator Annual Report, and others, require detailed information that fosters transparency and accountability. For those interested in ensuring proper documentation in Arizona as well, one key resource is an Arizona Lease Agreement form that can be found here: https://arizonapdf.com/, which serves a similar purpose in outlining the responsibilities and expectations between landlords and tenants.

Another comparable document is the Florida Third-Party Administrator Annual Report. Like the Alaska 08 309 form, this report requires TPAs to submit information regarding their operations, including employee lists and insurer contracts. Both documents are designed to maintain oversight of TPAs, ensuring that they operate within the legal framework established by state law. The frequency of reporting may differ, but the core purpose of regulatory compliance remains consistent across both forms.

The New York Third-Party Administrator Registration Application shares similarities with the Alaska 08 309 form in that it also requires TPAs to provide comprehensive information about their business operations. This includes identifying key personnel responsible for TPA functions, which is a common requirement in both documents. The New York application emphasizes the importance of maintaining accurate records and accountability, aligning with the goals of the Alaska form to ensure that TPAs adhere to state regulations.

Additionally, the Texas Third-Party Administrator Registration Form is another document that resembles the Alaska 08 309 form. Both forms require the submission of a list of insurers under contract and details about the TPA’s employees. This alignment helps state regulators assess the activities of TPAs and their compliance with local laws. The Texas form, much like its Alaska counterpart, aims to foster a transparent relationship between TPAs and regulatory bodies.

Finally, the Illinois Third-Party Administrator Application serves as another example of a document similar to the Alaska 08 309 form. Both documents require TPAs to disclose their business address, contact information, and details about the insurers they represent. The Illinois application also seeks information on key personnel, reinforcing the need for accountability within the TPA's operations. This shared focus on regulatory compliance underscores the importance of maintaining standards in the insurance industry across different states.