ENDORSEMENT FEES: $100 per location, in addition to the Business License fee, is non-refundable once the endorsement has been issued. Endorsements expire on the same date as the business license to which they are attached. For more information see the instructions on the Endorsement page and go to www.BusinessLicense.Alaska.Gov, click Endorsement FAQs. The Endorsement page must be completed and submitted with the business license application if you are purchasing an Endorsement.

TIP: The endorsement fee is a flat rate of $100 per location, whether you purchase a one or two-year business license. For a better bargain, purchase your business license with endorsement(s) for a two-year period.

PART III: SIX-DIGIT NAICS CODES

Provide the six-digit NAICS (North American Industry Classification System) code(s) which best describe your primary and/or secondary lines of business activities. For more information, including how to determine your business’ six-digit NAICS Code(s) go to www.BusinessLicense.Alaska.Gov and click Line of Business/Alaska NAICS Code.

IMPORTANT: The State of Alaska uses the 2007 six-digit NAICS Codes. The first two digits of the six-digit NAICS Code(s) identify your Line(s) of Business and will appear on your business license certificate.

You may provide up to ten (10) NAICS Codes.

PART IV: ALASKA PROFESSIONAL LICENSE NUMBERS

Any line of business, based on the six-digit NAICS Code(s), subject to a professional license, per AS 43.70.020(d), must be listed as the primary and/or secondary line of business, per 12 AAC 12.030(2), on the business license application.

IMPORTANT: If a line of business is subject to a professional license then you must obtain and provide a current Alaska professional license number prior to obtaining an Alaska Business License. For more information go to

www.ProfessionalLicense.Alaska.Gov

To determine if the six-digit NAICS code for your business activity requires a professional license go to www.BusinessLicense.Alaska.Gov and click Line of Business/Alaska NAICS Code. If the six-digit NAICS code you choose is listed in italicized, bold print then you may require professional licensing.

Provide the owner’s name as it appears on the professional license. Owners for the following professions may be an individual or an entity: Architects, Engineers, and Land Surveyors; Construction Contractors; Public Accountancy; Collection Agency; or Big Game Guides or Transporters.

In addition, if you will be practicing one of the following professions then check the appropriate box to identify if you are renting a chair from a Shop Owner or if you are the Shop Owner:

• |

Barber |

• |

Body Piercing |

• |

Esthetician (skin care) |

• |

Manicurist |

• |

Tattooing |

• |

Hairdresser |

•Permanent Cosmetic Coloring

For more information go to www.BusinessLicense.Alaska.Gov and click on Barber and Hairdressers FAQs.

PART V: SIGNATURE

Provide the printed name, title, signature, date, phone number and email.

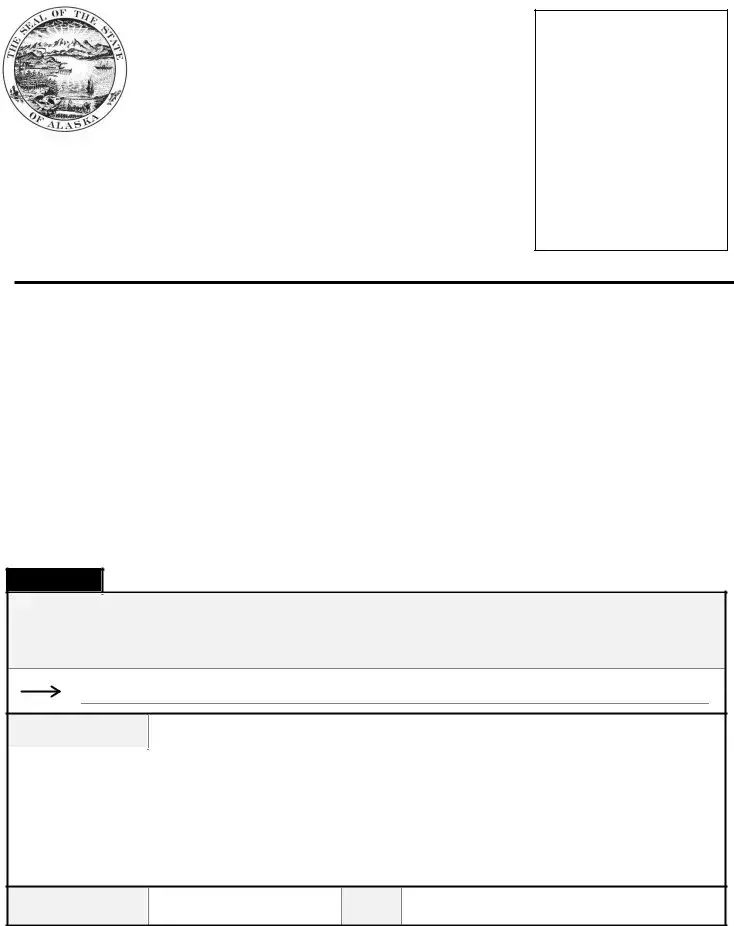

PART VI: ENDORSEMENT RENEWAL INSTRUCTIONS

Effective 1/1/2019: An Endorsement is required to sell tobacco products, electronic smoking products, or products containing nicotine.

If you sell products requiring an Endorsement, then you must have an Endorsement. An Endorsement cannot stand on its own: it must be attached to a current business license.

•Location: A separate endorsement is required for each physical location where products requiring an Endorsement will be sold.

•Endorsement Fee(s): $100 per location in addition to the business license fee.

•Expiration Date: Endorsements will expire on the same date as the business license to which they are attached. Endorsements must be renewed at the same time as the business license to which they are attached.

TIP: The endorsement fee is a flat rate of $100 per location, whether you purchase a one or two-year business license. For a better bargain, purchase your business license with endorsement(s) for a two-year period.

•Required Signage: A person who holds an Endorsement must post on the licensed premises a warning sign. This sign must be displayed in a conspicuous location to a person purchasing or consuming products requiring an Endorsement. There are significant penalties for improper sales of products requiring an Endorsement. It is the licensee’s responsibility to be familiar with the proper sale of products requiring an Endorsement. AS 43.70.075(f)

For more information go to: www.BusinessLicense.Alaska.Gov and click on Endorsement FAQs