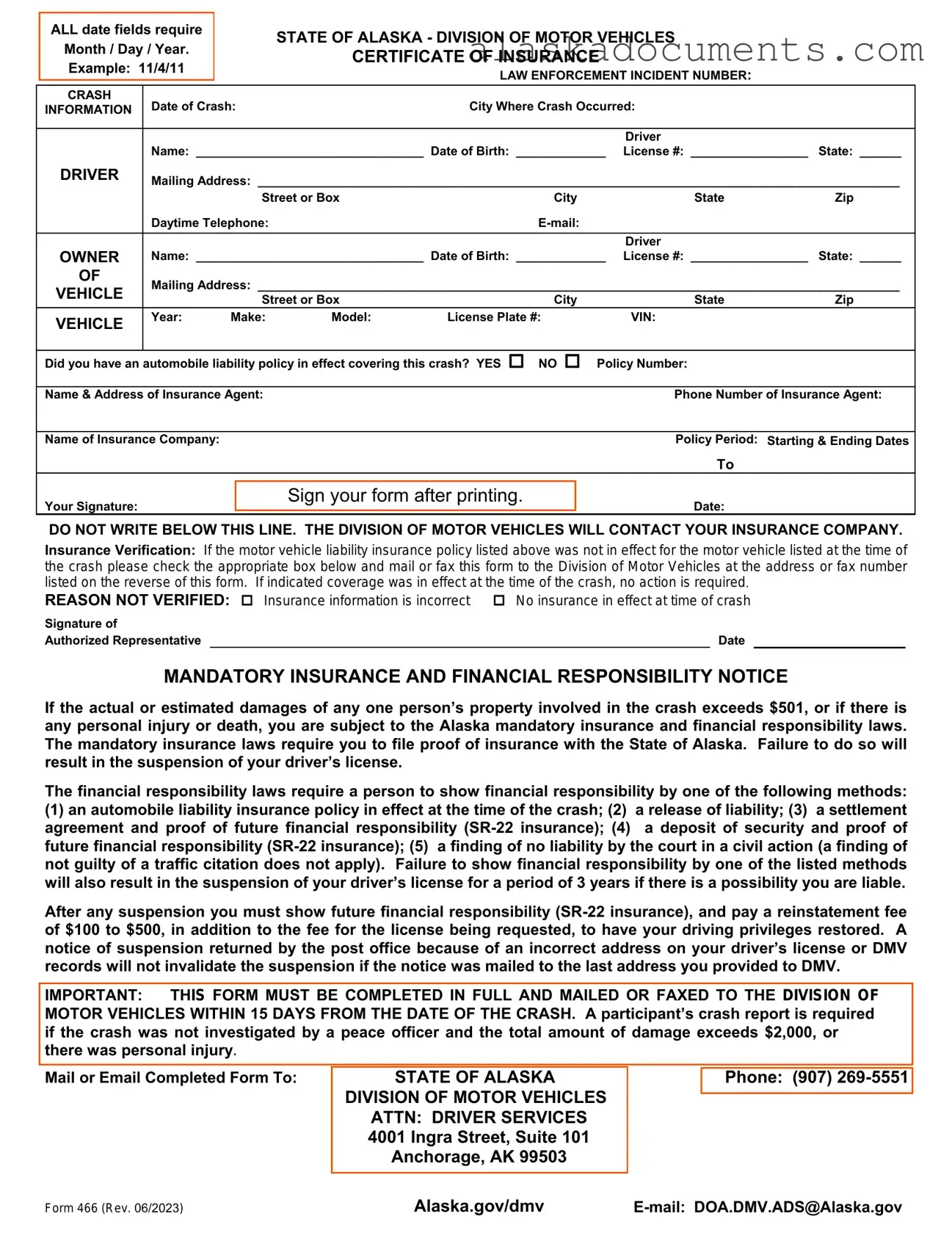

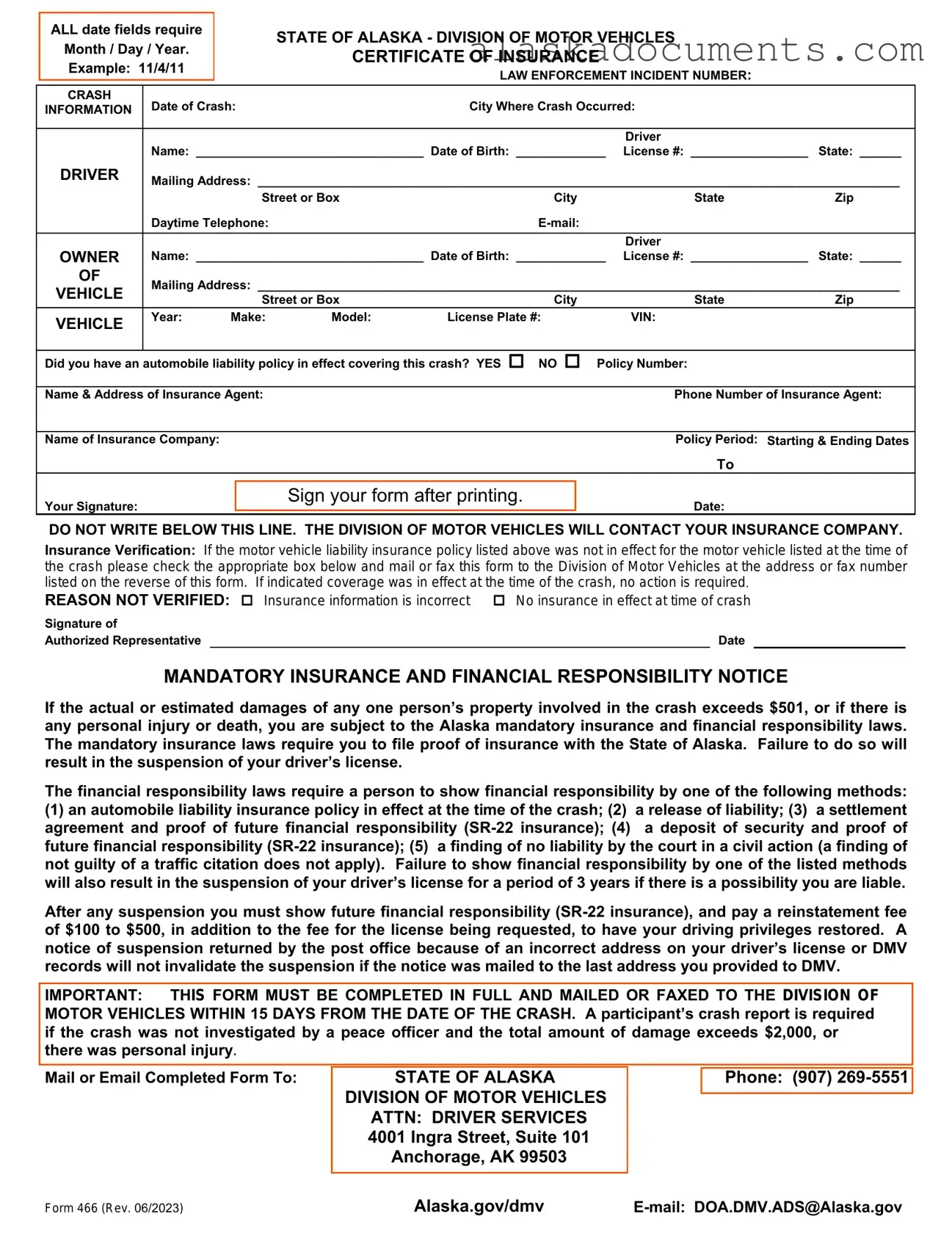

The Alaska 466 form shares similarities with the SR-22 form, which is a certificate of financial responsibility. Both documents serve to demonstrate that a driver has the required insurance coverage. The SR-22 is often mandated for individuals who have had their driving privileges suspended due to violations related to insurance. Just like the Alaska 466, the SR-22 must be filed with the state to ensure compliance with financial responsibility laws.

Another document similar to the Alaska 466 is the Certificate of Liability Insurance. This certificate provides proof of insurance coverage for individuals or businesses. Both forms require details about the insured party, the policy number, and the insurance provider. They are essential in verifying that the necessary insurance is in place at the time of an incident, such as a vehicle crash.

The Motor Vehicle Accident Report (MVAR) is also comparable to the Alaska 466 form. The MVAR is typically filed after a traffic accident and includes details about the incident, including parties involved and damages. Like the Alaska 466, it serves to document the event for insurance purposes and may also be used in legal proceedings if necessary.

In addition to the various forms discussed, it is crucial to understand the significance of having proper documentation for any sale or transfer of ownership, such as a onlinelawdocs.com/bill-of-sale/, which serves as an essential tool in any transaction to prevent disputes and protect the rights of both parties involved.

Similarly, the Proof of Insurance Card functions as a quick reference for drivers to show that they have valid insurance coverage. Both the Proof of Insurance Card and the Alaska 466 require the driver’s information, policy number, and insurance company details. They are crucial for compliance with state laws regarding financial responsibility.

The Declaration Page of an Insurance Policy is another document that aligns with the Alaska 466 form. This page summarizes the terms of the insurance policy, including coverage limits and effective dates. Both documents serve as proof of insurance, ensuring that the driver meets state requirements during and after an accident.

The Financial Responsibility Insurance Form is also similar to the Alaska 466. This form is often required after a traffic violation or accident to prove that the driver has adequate insurance coverage. Both documents emphasize the importance of maintaining financial responsibility and require timely submission to the relevant authorities.

The DMV's Insurance Verification Form is akin to the Alaska 466 in that it is used to confirm the existence of insurance coverage. This form collects similar information regarding the driver, vehicle, and insurance policy. Both are essential for ensuring compliance with state insurance laws following a vehicle incident.

Lastly, the Accident Report Form is comparable to the Alaska 466 as it documents the specifics of a vehicle accident. This form collects detailed information about the crash, including the parties involved and circumstances. Both forms are critical for processing insurance claims and ensuring that all parties meet their financial responsibilities following an accident.