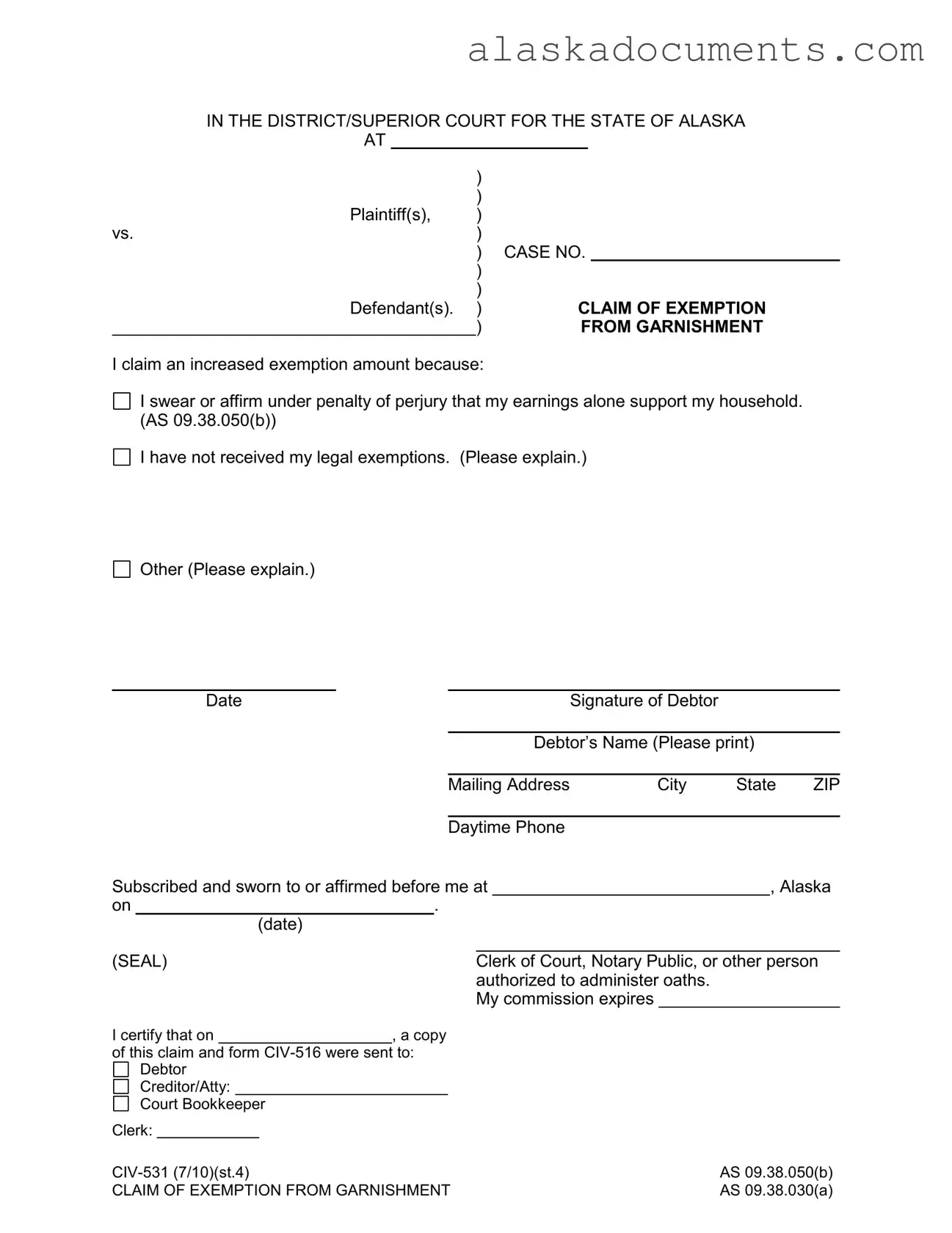

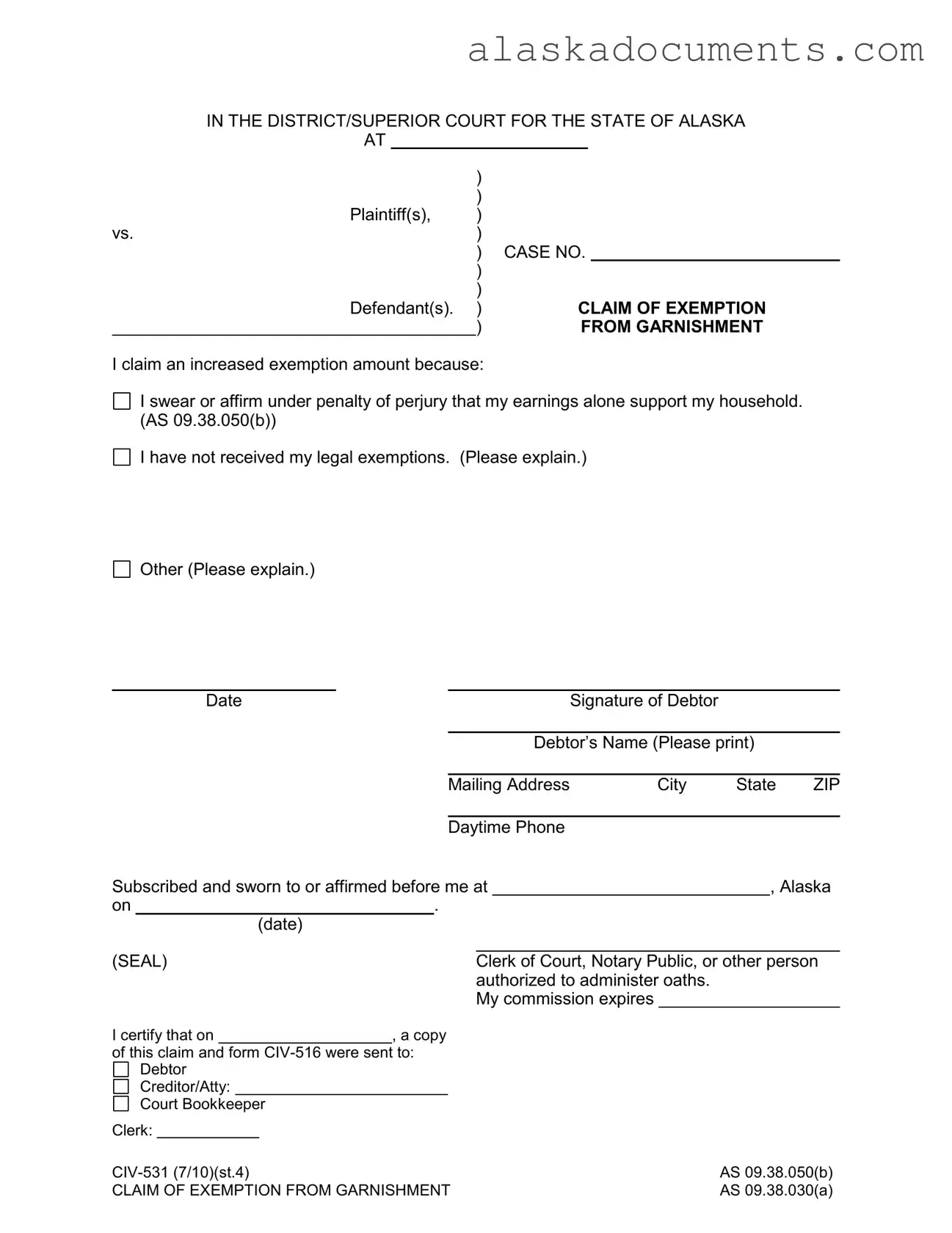

The Alaska Civ 531 form serves as a formal declaration of exemption from garnishment, and it shares similarities with the Federal Form 105, which is utilized in bankruptcy proceedings. Both documents allow individuals to assert their rights regarding exemptions, protecting certain assets from creditors. Just as the Alaska Civ 531 requires the debtor to provide specific reasons for claiming exemptions, the Federal Form 105 also necessitates a detailed explanation of the grounds for exemption. This ensures that both forms facilitate transparency and provide a clear basis for the claims being made.

Another document comparable to the Alaska Civ 531 is the California Claim of Exemption form. Like the Alaska form, the California version allows individuals to claim exemptions from wage garnishments. Both forms require the claimant to affirm their financial situation, including details about household support and any legal exemptions previously received. This parallel emphasizes the importance of documenting one’s financial circumstances to prevent undue hardship due to garnishment.

The Texas Claim for Exemption form is yet another document that mirrors the Alaska Civ 531. In Texas, individuals facing garnishment can use this form to assert their rights to certain exemptions. Both documents require claimants to provide personal information, including their name, address, and the specific reasons for claiming exemptions. This shared structure highlights a common goal: to protect individuals from losing essential income or assets due to creditor actions.

Additionally, the Florida Claim of Exemption form is similar in purpose and function to the Alaska Civ 531. Both forms allow individuals to formally declare their exemption status and provide the necessary information for creditors and the court. They require a sworn statement affirming the accuracy of the information provided, ensuring accountability. This requirement serves to uphold the integrity of the claims being made and offers a legal safeguard for individuals facing garnishment.

The California Homeschool Letter of Intent is an important step for parents choosing to educate their children at home. By filing this document, families can ensure compliance with state regulations, thereby fostering a supportive and legally sound educational environment. For more details, you can refer to the guideline on the Homeschool Letter of Intent.

Finally, the New York Exemption Claim form aligns with the Alaska Civ 531 in its objective to protect individuals from garnishment. In New York, the form allows debtors to assert their rights to certain exemptions, similar to the Alaska form. Both documents require the individual to articulate their financial circumstances and the basis for claiming an exemption. This process not only aids in the protection of essential income but also fosters a clearer understanding of the debtor’s financial situation for all parties involved.