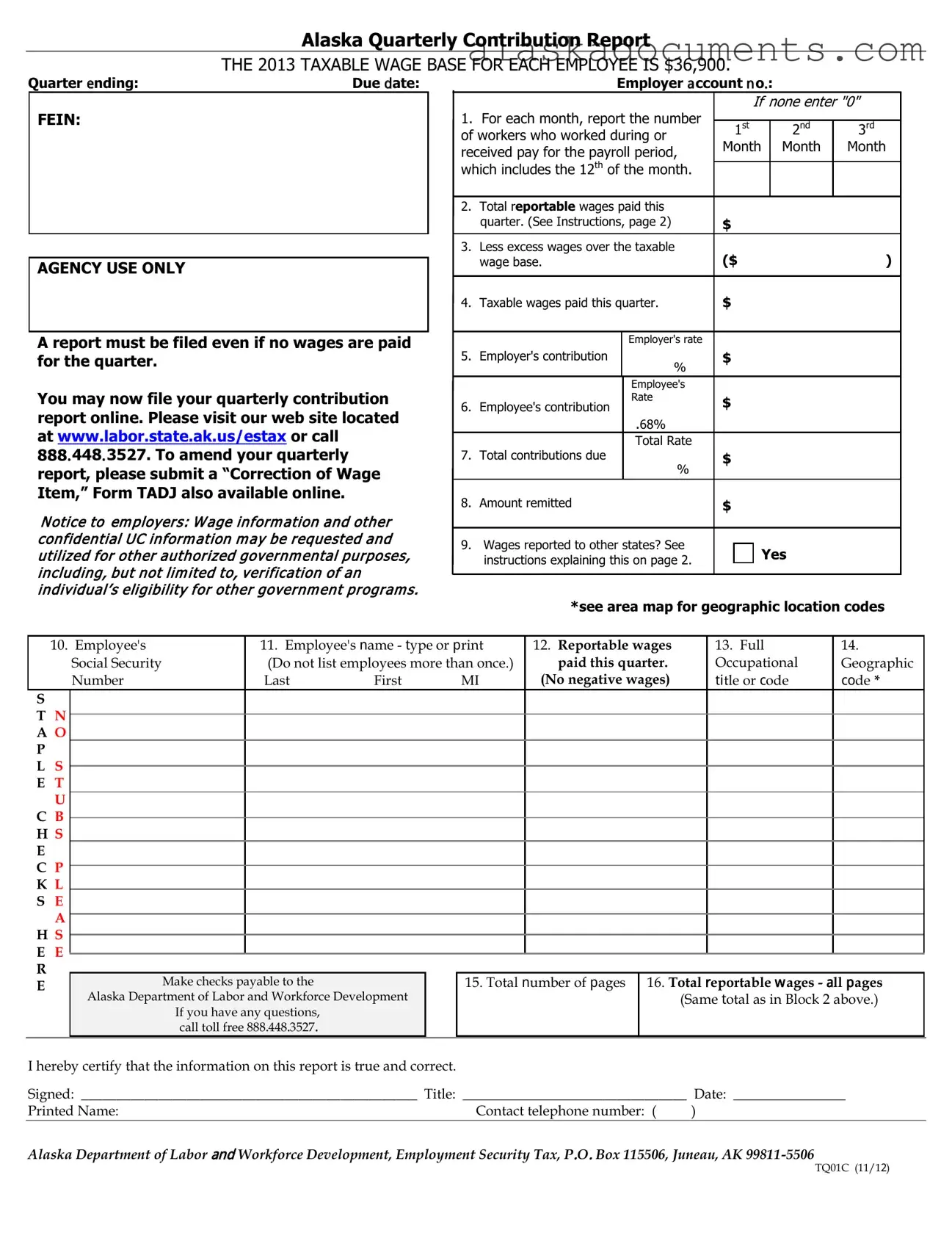

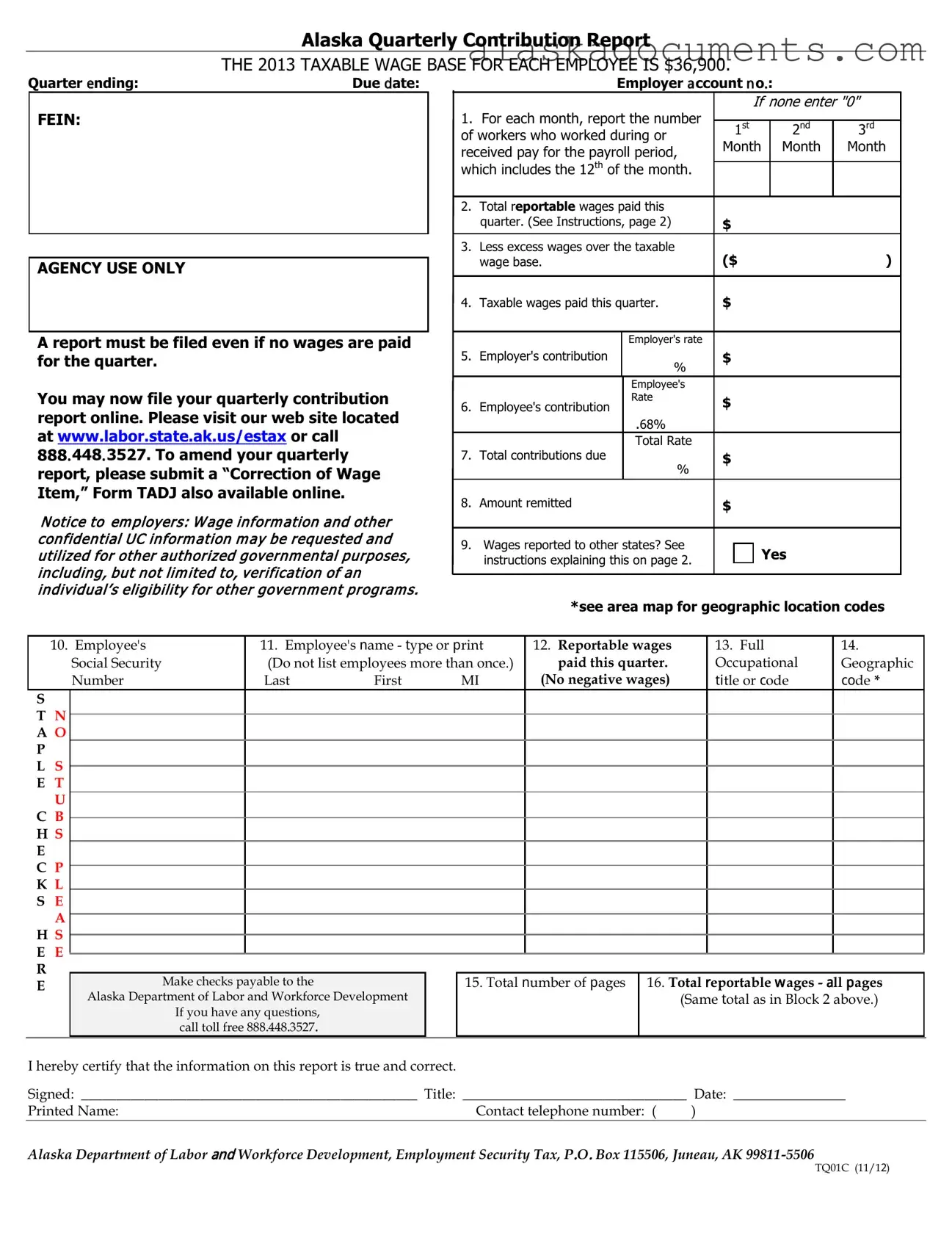

The Unemployment Insurance (UI) Contribution Report is similar to the Alaska Quarterly Contribution Report in that both documents require employers to report wages and contributions related to unemployment insurance. Each report includes details on the number of employees, total wages paid, and the taxable wage base. Employers must submit these reports quarterly, ensuring compliance with state regulations. Just like the Alaska report, the UI Contribution Report may also require employers to indicate if they have paid wages to employees in other states.

When dealing with transactions involving vehicles, it's critical to have the appropriate documentation in place. For those looking to document the sale of a quad, a vital resource is the Bill of Sale for a Quad. This document not only serves as a receipt but also legally verifies the transfer of ownership and details the specifics of the transaction, ensuring both the buyer and seller are protected under the law.

The Wage and Tax Statement, commonly known as Form W-2, shares similarities with the Alaska Quarterly Contribution Report as it summarizes an employee's annual wages and the taxes withheld. Employers must provide a W-2 for each employee at the end of the year, detailing wages paid throughout the year. While the Alaska report is quarterly, both documents are essential for accurate tax reporting and compliance with federal and state tax laws.

The Employer's Quarterly Federal Tax Return, or Form 941, is another document akin to the Alaska Quarterly Contribution Report. It requires employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. Like the Alaska report, Form 941 is submitted quarterly and helps ensure that employers fulfill their tax obligations. Both forms require careful calculation of wages and contributions for accurate reporting.

The State Payroll Tax Return is similar in purpose to the Alaska Quarterly Contribution Report, as it requires employers to report payroll taxes owed to the state. This document includes information on employee wages, tax rates, and total contributions. Both reports are crucial for maintaining compliance with state tax laws, and they help states track employment and revenue for public services.

Finally, the Annual Report of Employee Wages is comparable to the Alaska Quarterly Contribution Report because it provides a summary of wages paid to employees over a year. While the quarterly report focuses on a specific time frame, the annual report compiles all wage data for the year. Both documents serve to keep employers accountable for reporting accurate wage information and ensuring that contributions are made in accordance with state and federal regulations.