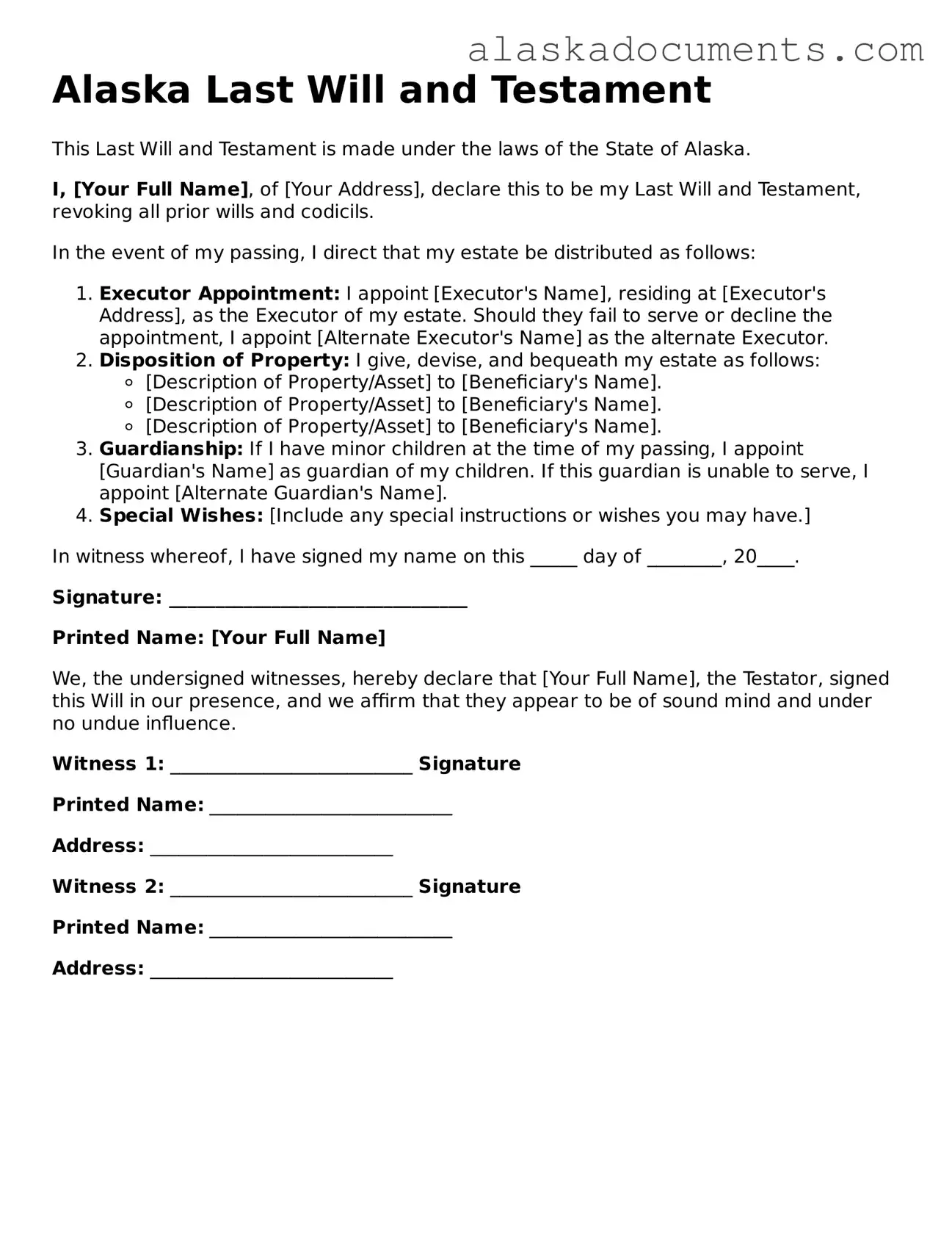

The Alaska Last Will and Testament form shares similarities with a Living Will, which is a legal document that outlines an individual's preferences regarding medical treatment in the event they become incapacitated. While the Last Will focuses on the distribution of assets after death, a Living Will addresses healthcare decisions during one’s lifetime. Both documents serve to express personal wishes, ensuring that the individual’s desires are respected, whether concerning property or medical care.

Another document comparable to the Alaska Last Will and Testament is a Durable Power of Attorney. This form allows an individual to designate someone else to make financial or legal decisions on their behalf if they become unable to do so. Like a Last Will, it is essential for planning ahead and ensuring that one’s affairs are handled according to their wishes. However, the Durable Power of Attorney takes effect during the individual’s lifetime, contrasting with the Last Will, which only becomes effective after death.

The Revocable Living Trust is another document that parallels the Last Will and Testament. A Revocable Living Trust allows individuals to place their assets into a trust during their lifetime, with the ability to alter or dissolve the trust as needed. This document can help avoid probate, a process that the Last Will typically goes through. Both instruments aim to facilitate the distribution of assets, yet they do so in different manners and with varying degrees of privacy and control.

Similar to the Last Will, a Codicil is an amendment or addition to an existing will. It allows individuals to make changes without needing to create an entirely new document. This can be particularly useful for updating beneficiaries or altering specific bequests. Like the Last Will, a Codicil must be executed with the same legal formalities to ensure its validity, maintaining the integrity of the individual’s final wishes.

The Living Trust is often discussed alongside the Last Will and Testament, as both serve to manage an individual's estate. A Living Trust allows the creator to maintain control over their assets while alive, and upon their death, the assets can be distributed according to the terms set forth in the trust. This document can help avoid the lengthy probate process associated with a Last Will, providing a smoother transition of assets to beneficiaries.

Another important document is the Healthcare Proxy, which designates someone to make medical decisions on behalf of an individual if they are unable to do so. While the Last Will addresses the distribution of property, the Healthcare Proxy focuses on health-related decisions. Both documents are crucial for ensuring that personal wishes are honored, whether in matters of property or health care.

In addition to the legal documents mentioned, a Bill of Sale form is also critical in various transactions. This form not only confirms the transfer of ownership of an asset but also serves as legal proof of the purchase, detailing important aspects such as the condition and price of the item sold. Understanding the importance of such documents can streamline future agreements, ensuring clarity between the parties involved; for more information, you can visit https://onlinelawdocs.com/bill-of-sale.

The Affidavit of Heirship is also similar to the Last Will and Testament, as it helps establish the heirs of a deceased individual. This document is often used when a person dies without a will, providing a way for heirs to claim property. While the Last Will clearly outlines a person’s wishes regarding asset distribution, the Affidavit serves to affirm the legal status of heirs, ensuring that the deceased’s estate is settled in accordance with the law.

Lastly, the Guardianship Designation is another document that relates to the Last Will and Testament, particularly for individuals with minor children. This document allows parents to designate a guardian for their children in the event of their death or incapacity. While the Last Will covers the distribution of assets, the Guardianship Designation focuses specifically on the care and upbringing of children, ensuring that their welfare is prioritized alongside the management of the estate.