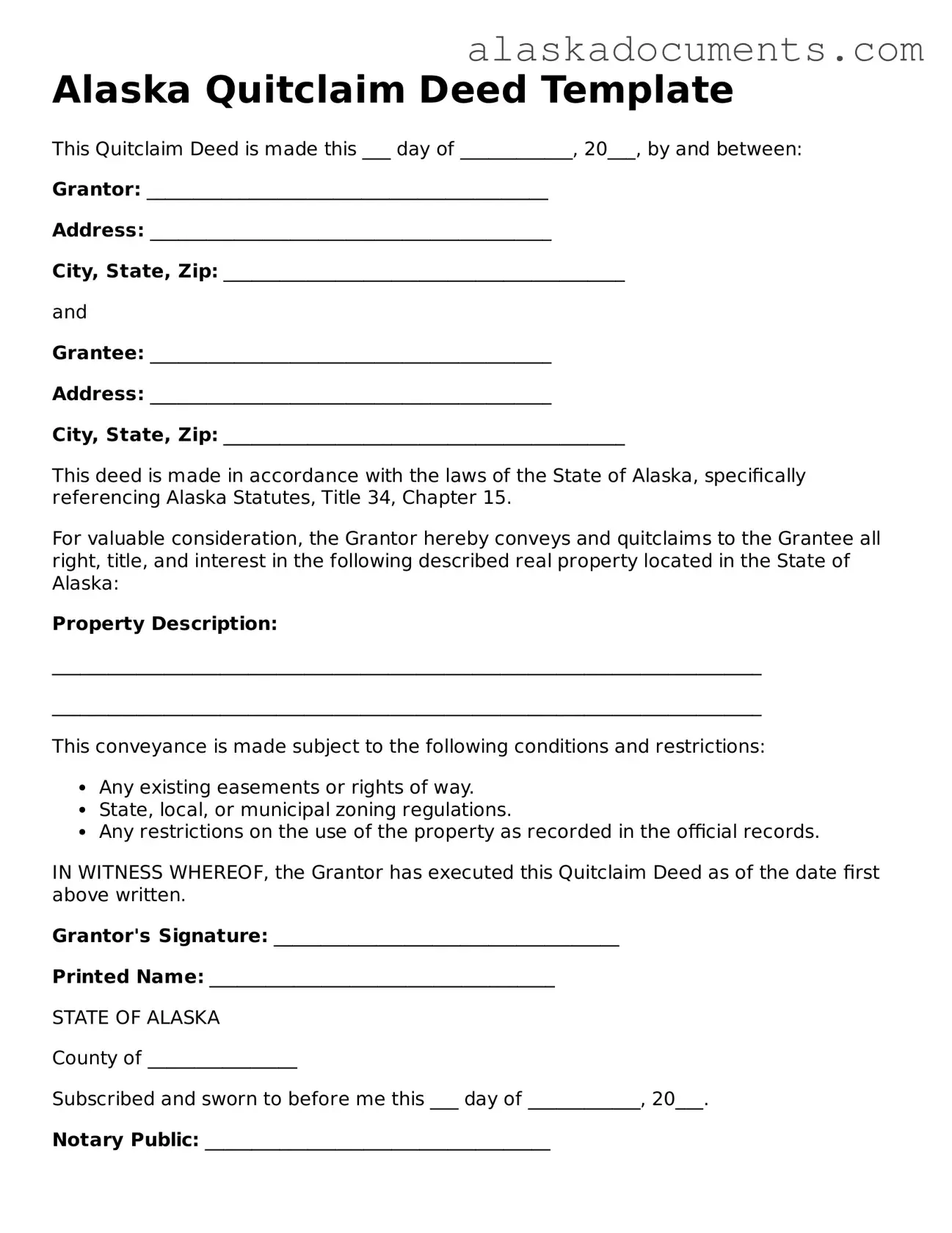

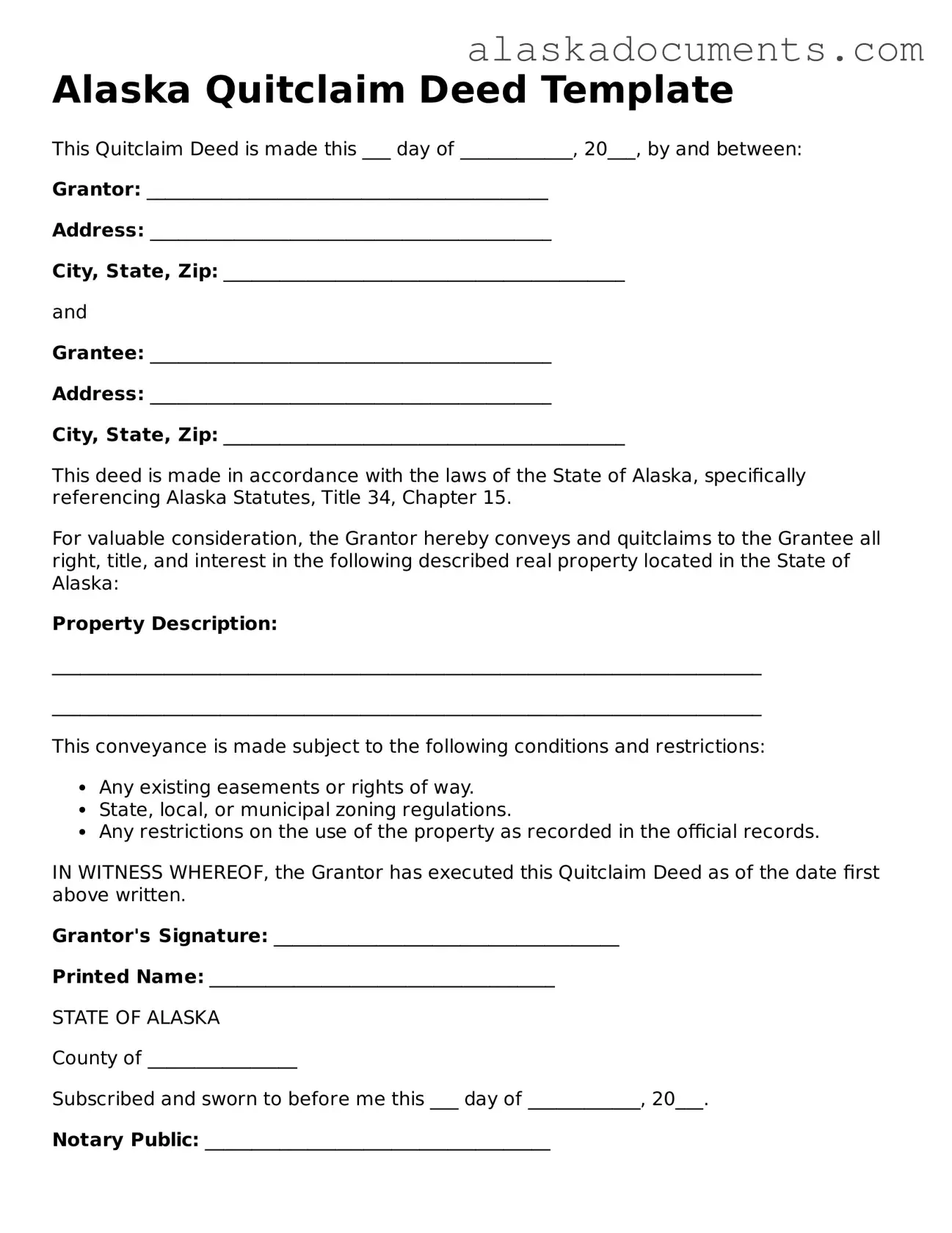

Fillable Alaska Quitclaim Deed Template

A Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without guaranteeing that the title is clear. This form is particularly useful in situations where the granter may not have complete ownership rights or wishes to relinquish any claim to the property. In Alaska, understanding the nuances of the Quitclaim Deed can help individuals navigate property transactions more effectively.

Access Your Quitclaim Deed

Fillable Alaska Quitclaim Deed Template

Access Your Quitclaim Deed

Access Your Quitclaim Deed

or

▼ Quitclaim Deed PDF

Complete the form and get on with your day

Complete Quitclaim Deed online — edit, save, download with ease.