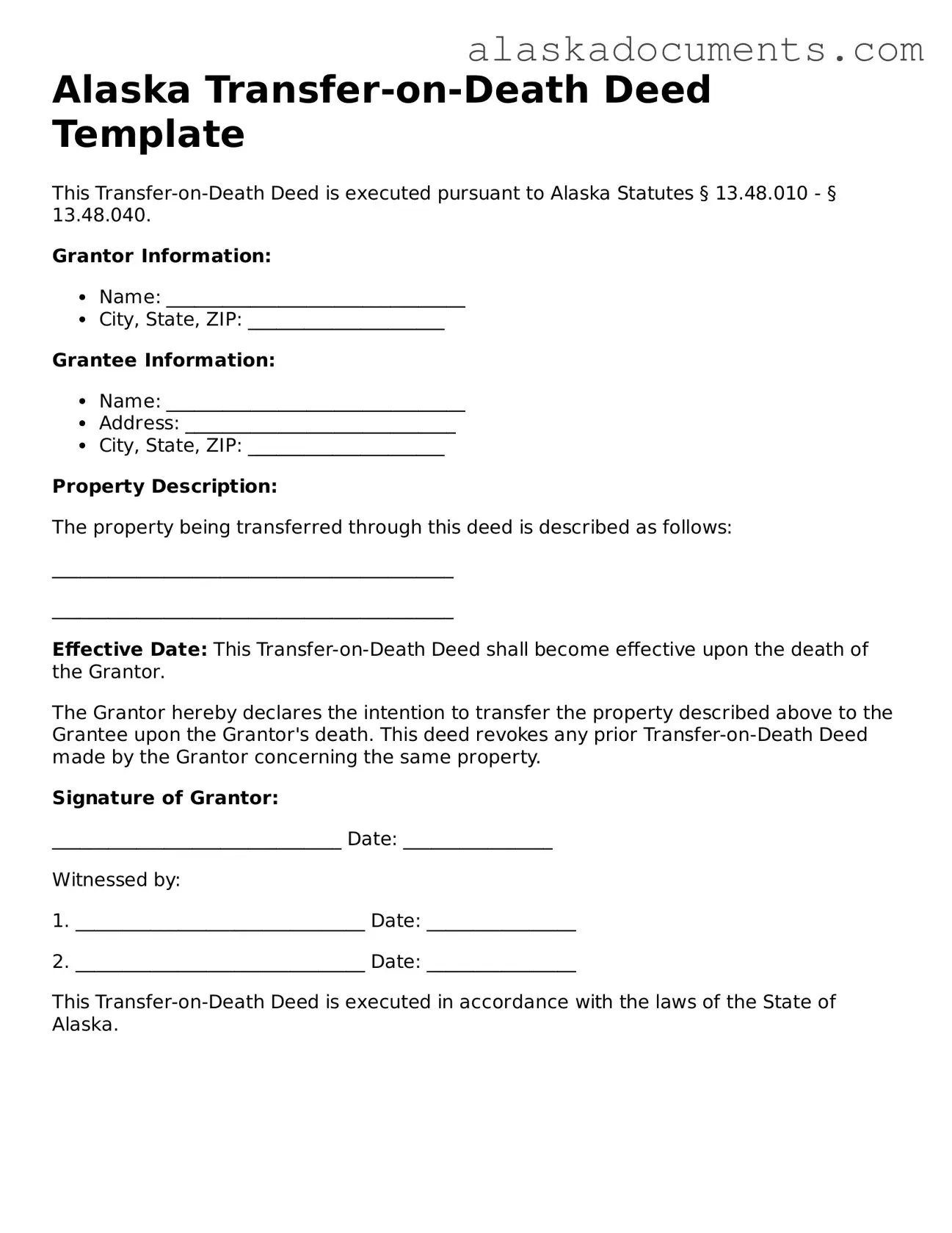

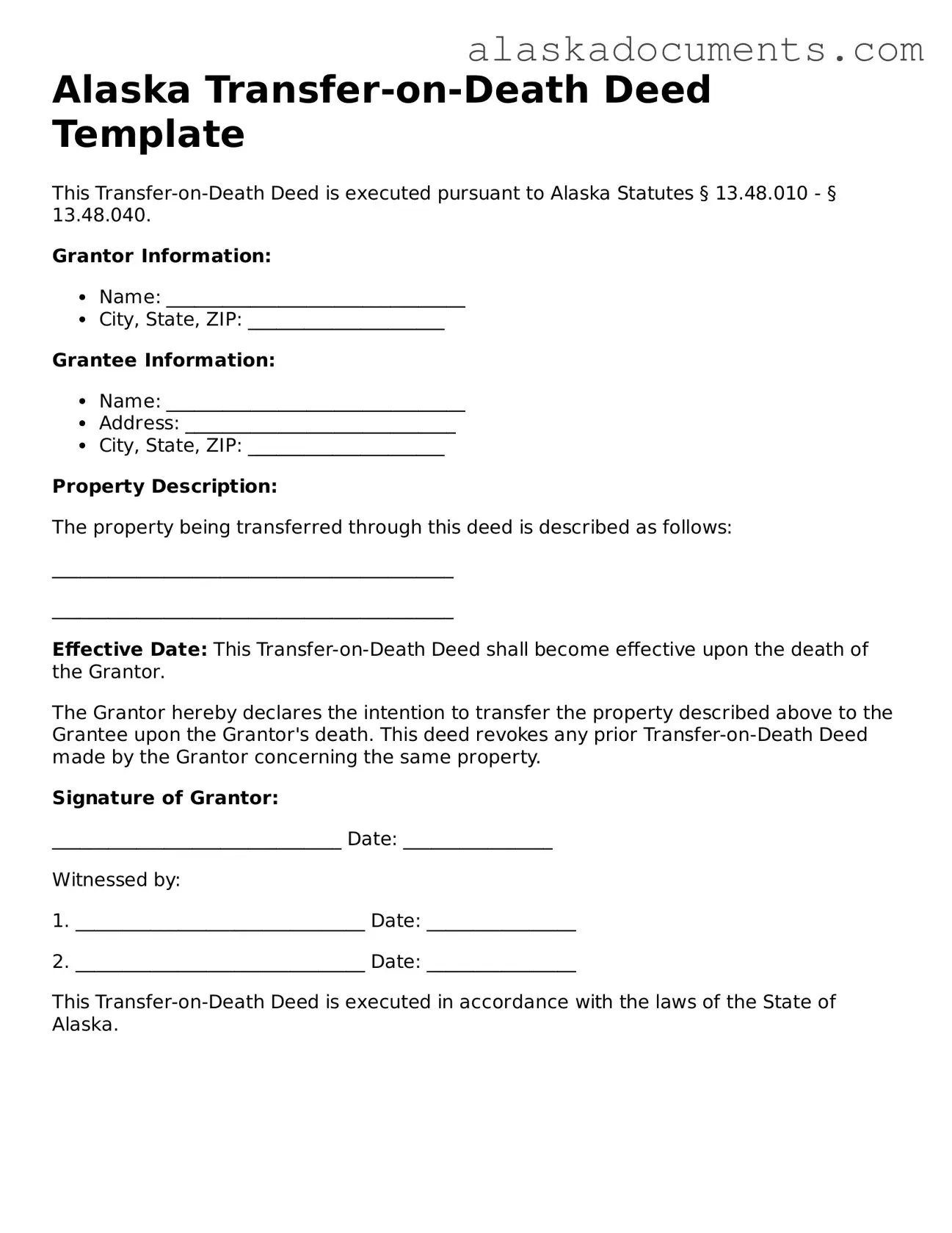

Fillable Alaska Transfer-on-Death Deed Template

The Alaska Transfer-on-Death Deed form is a legal document that allows property owners to designate beneficiaries who will receive their property upon their death, without the need for probate. This form simplifies the transfer process and can provide peace of mind for individuals looking to ensure their loved ones are taken care of after they pass away. Understanding how to properly use this form is essential for effective estate planning in Alaska.

Access Your Transfer-on-Death Deed

Fillable Alaska Transfer-on-Death Deed Template

Access Your Transfer-on-Death Deed

Access Your Transfer-on-Death Deed

or

▼ Transfer-on-Death Deed PDF

Complete the form and get on with your day

Complete Transfer-on-Death Deed online — edit, save, download with ease.